The first time I wandered on to the NBA Top Shot website and took a look at the marketplace, I was overwhelmed to say the least. The website is impressive, the design element is very appealing, but trying to find the best NBA Top Shot Moments to buy can be a daunting task. Where do you even start?

Reading this guide on how to find the best Top Shot Moments will provide a little guidance and help you narrow down your options. To find the best NBA Top Shot Moments for you, follow these 7 rules:

- Perform Market Research

- Set a budget

- Make a list of Moments you want to own

- Diversify

- Be Patient

- Keep it Fun

- Don’t Overtrade

I will break down each of these 7 rules in detail and provide the most valuable Top Shot resources you need to succeed.

Defining Best NBA Top Shot Moments

Before trying to find the best NBA Top Shot moments, you first need to define what that means for you. Are you trying to buy, sell, and trade Top Shot moments to generate income? Do you aim to be a long term collector? Are you buying them as a long term investment? Or do you simply want to own moments of your favorite players and teams?

Understanding what you want out of collecting Top Shot moments will help you define what “best” Top Shot moments means and develop a strategy.

7 Rules for Finding the Best NBA Top Shot Moments

1. Do Your Research First

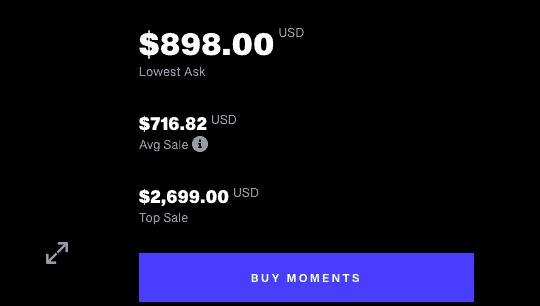

As with any investment strategy, having a defined plan is key to success. Stumbling into Top Shot’s marketplace without a plan can lead to impulse buys and regret. In order to develop a solid strategy, one must do market research. While the Top Shot website provides data on the highest sale, average price, and the lowest ask, this data is incomplete and does not constitute market research.

NBA Top Shot Market Research Tools

Before getting into the various Top Shot market research tools, know the first mistake you need to avoid. Don’t use the data listed on the NBA Top Shot marketplace as your price information. When you select a moment in the marketplace, you will see 3 pieces of price information:

- Lowest Ask (The lowest price you can expect to pay)

- Avg. Sale (Average sale price over the last 60 days)

- Top Sale (Highest Sale – all time)

The problem with this information is it is incomplete. Especially with lower edition size moments, one sale can greatly skew the average price. One can easily get fooled into thinking they are getting a great deal if the average sale is higher than the lowest ask when, in reality, someone could have skewed the average by paying overprice. 60 days is also a long time and you should be measuring the most recent price data possible.

Moment Ranks

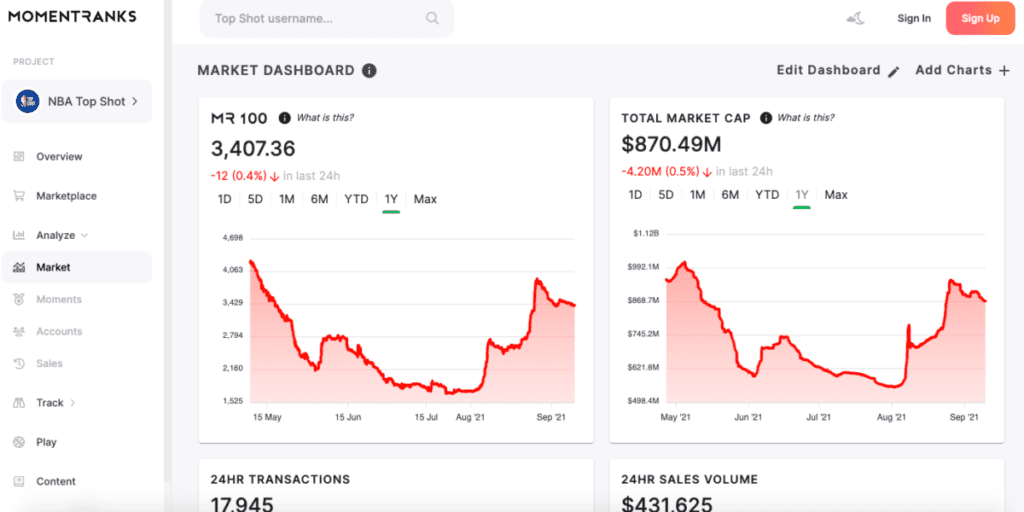

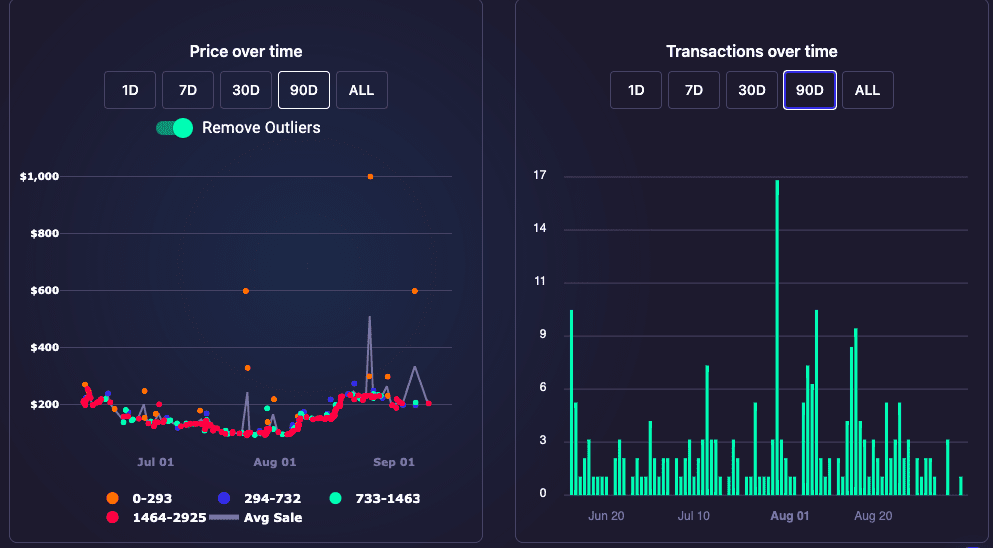

Moment Ranks is website that specializes in data insights for NFTs with a heavy emphasis on NBA Top Shot. Moment Ranks has excellent price data and data visualization for both the NBA Top Shot market as a whole and for individual moments. I’m a visual person so looking at price charts makes a lot more sense to me. I generally want to be buying stocks, nfts, or any asset as it is trending upward. Moment Ranks allows you to analyze the Top Shot market by looking at charts of Total Market Cap, Sales Volume, and the MR 100 (an index of 100 Moments chosen to reflect the Top Shot market as a whole. Think of the S&P 500).

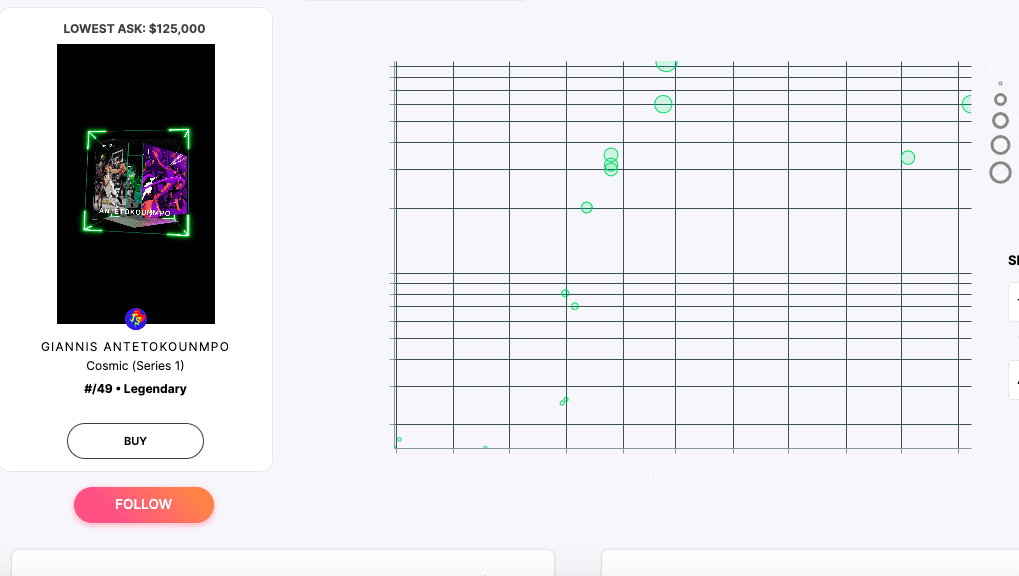

Moment Ranks also provides data on individual Moments. You are able to see charts and visualization tools of each Moment along with a complete sales history. The complete sales history is important information as you can see each transaction of a moment by date. Price information is important but liquidity is also. Seeing recent transactions will give you an idea of the liquidity of any given Moment.

Lastly, Moment Ranks provides data on individual accounts. You can find out who the biggest holders are, what they are holding, and how much they have profited. Studying some of the top holders is a great way to track the “whales” and get an idea of how successful traders build their portfolio.

Evaluate Market

Evaluate Market is very visually appealing and has some great tools within the site. As a whole, I prefer Moment Ranks for NBA Top Shot for the charts and more complete data sets. Evaluate Market, however, has a wider offering of NFTs to research. Moment Ranks really only covers Top Shot and Bored Ape Yacht Club.

Evaluate Market does have two great tools in the Rarity page and Porfolio tool. The Portfolio allows you to link your own portfolio for analysis or look at other portfolios in the Top Shop market. Again, this allows you to get an in-depth look at the top holders and see what they are buying.

Crypto Slam

Crypto Slam is one of the best NFT resources period. If you are looking to keep tabs on the NFT market as a whole, this is your one stop shop. By clicking on any NFT, you can see a quick chart of sales volume, market cap , and how many buyers/sellers there are on any given day. CS also has market caps for individual Moments, players, or series.

There is some unique data, quick information you can gather without getting lost, and a “Crypto Slam Value” chart on each Moment. The CSV chart is a good visualization but I worry the data is not accurate enough as it is only based on Lowest Ask and doesn’t include complete price information. This can be problematic as some Moments have very few actual sales and the ‘Lowest Ask’ can be misleading.

NBA Top Shot Discord & Twitter

Gary Vaynerchuk is an important figure in the NFT world and you should give him a follow if you plan on diving into this. Gary Vee recommends going straight the the Discord channel and to twitter to start educating yourself on any NFT. Getting into a Discord can be intimidating but just get in there and start reading until you get comfortable. People are generally very accommodating and will answer your questions.

Twitter can also be a great educational resource. Follow Top Shot experts, ask questions in DM and in threads, learn as much as you can before you start spending. Here are some good Top Shot Follows to get you started on Twitter:

2. Set a Budget

If you view NBA Top shot a an investment, view it as a highly speculative investment. Top Shot moments can be extremely volatile and highly illiquid. When setting a budget, decide on an amount that you are comfortable losing if things go poorly. This will allow you to buy, sell, or trade with a clear head.

Here are the 3 main rules when setting a budget:

- ONLY PLAY WITH MONEY YOU CAN AFFORD TO LOSE

- Think of what you would like your budget to be. Then cut it in half. If you are successful, your budget will increase. If you are not successful, you still have half your budget to add to your account. Call the first half “market tuition”.

- Consider setting aside a monthly amount to add to your account (if your income allows). This enables you to hold on to your moments a little longer, knowing you have some funds coming in each month.

Set a budget, try to stick to it. If you are good at trading Top Shot, your budget will grow! If you are a buy and hold kind of person, start slow and try to set aside some recurring income.

3. Make a list of Players & NBA Top Shot Moments You Want to Own

For the buy and hold collector, this process is simple:

- Set aside a fixed amount of income/savings/fun money each month.

- Make a list of the players and Moments you want to own

- Perform market research

- Make a list of the Moments you most want to own

- Once you have a list to work off of, you can decide if you can afford the Moments at the top of your list or if you need to save up. This is a logical way to build a collection you are proud of and forces you to make sound decisions.

For the flipper/trader/investor, it is not so clear. Here is the way I approach it:

- Make a list of players you either a) want to own or b) think have a good chance to go up in value.

- Divide that list into 2 sub lists: Moments within your budget & Moments not within your budget

- Start with the moments within your budget and perform market research.

- Identify the best Moments within that list for potential short term gain (or long term gain if thats your thing).

- Start trying to trade up until you can afford Moments you couldn’t afford before!

Just like with sports cards, it helps for the beginner to niche down and focus on a smaller subset to research. Researching every Top Shot moment is overwhelming and darn near impossible if you have a full time job. Here are a couple ideas for niching down:

- Pick 3 or 4 players you like and become an expert on their Moments

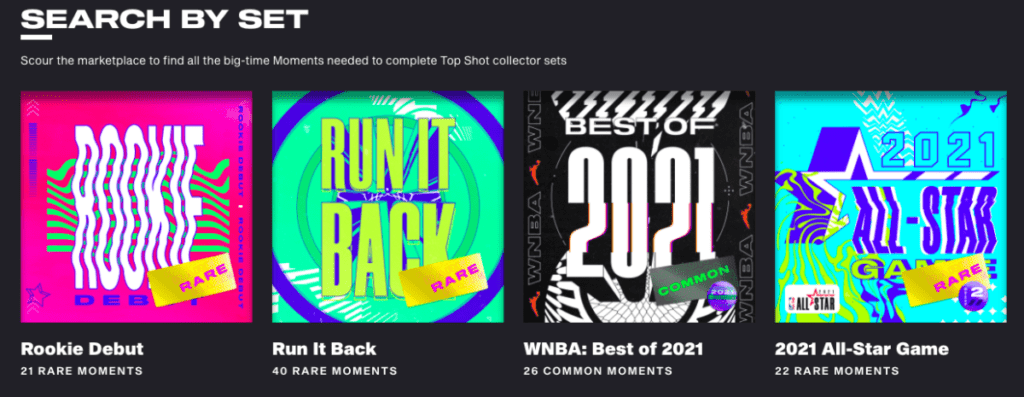

- Focus on specific Series like “Series 1” or “Run It Back”

- Think of Top Shot like a bunch of different “markets”. Find a market within Top Shot and study it until you know it top to bottom.

- Understand the laws of supply and demand. You want to buy moments where demand outpaces supply and the price goes up. Check the supply for each Moment and understand the dynamics of it.

4. Diversify

There are two ways you should diversify:

- Don’t spend your entire budget on one or two moments. I mean you can and I’m not telling you what to do, just my advise. Take at least some risk off by buying more moments. Especially if you are investing in younger players who stand a chance of getting injured and having their Moments lose value.

- Spread out your Moments between proven stars and younger players with potential. Like I said before, it is fun speculating on players futures and betting on their Moments. It is one of my favorite parts of NBA Top Shot and sports card collecting. However, speculating on a player’s future is just that…speculating. There is a great deal more risk in buying Ja Morant moments than Stephen Curry. Morant still has a lot to prove while Curry has most likely already cemented his place in the Hall of Fame.

I actually like to keep a pretty concentrated portfolio in most any asset but you need to be smart about it and diversity when possible.

5. Be Patient

FOMO is a real thing. I suffer badly from FOMO. It often costs me money. Remind yourself that there will always be more opportunities to speculate and there will always be hot, new trends. Do your research and take pride in knowing you have made an informed, well thought out decision. One of my favorite sayings in trading is “wait for the fat pitch”. Meaning, wait for that fastball down the middle.

The other part of staying patient is to keep some liquidity available for when the fat pitch comes. When you FOMO and buy the first thing you see, it ties up capital. In NFT trading, I have had so many times when a high probability opportunity has come along and I was illiquid and unable to move on it. Stay liquid if possible.

6. Keep It Fun

Don’t bet your life savings on this. You will be miserable if you invest too heavily (unless you invest heavily and get rich of course). Keep this light and fun. Invest in moments you will be enjoy owning. Don’t be too serious.

7. Don’t Overtrade

This goes right in step with #5. Staying patient and having a plan will keep you from overtrading. FOMOing will lead you to overtrading. Overtrading will cause you to make poor purchases and rack up transaction fees which will end up costing you money. It is a good idea in general to start of slow and with a small amount of your overall budget. If you prove to yourself that you can make money doing this, then start trading more but be patient early.