NFT ownership is becoming more and more mainstream these days. Motivations range from wanting to collecting art, to just “getting in on the fun”, to trying to get filthy rich. Whatever your motivation, you need to realize this is going to cost money and is an investment. You should know what to look for in an NFT investment or you could fall prey to impulsive buying and the dreaded state of constant illiquidity (believe me, I know.)

Regardless of your motivation, it’s a good idea to come up with some sort of checklist or grading sheet to measure an NFT investment. If you are looking to make consistent money trading NFT’s, you really need this kind of tool or you could easily see your account run down to zero with only a bag full of worthless jpegs to show for it. I have come up with a list of 7 things you should look for in an NFT project. Follow this process and you are likely to end up buying NFTs without regret and a greater possibility of unearthing one of the next big NFT project.

1. Look For NFT’s That Are Budget Friendly

For something to be “budget friendly”, you need to set a budget for yourself. Ask yourself a few questions first:

- What are you wanting to get out of buying NFTs?

- Are you simply looking to collect art you can display?

- Are you wanting to flip NFTs?

- Are you wanting to buy for long term appreciation?

- Is it a combination of all of the above?

Asking these questions will help you understand your own motivations, set an appropriate budget, and develop an NFT investing strategy. I am still in my NFT collecting infancy and I have struggled with finding an identity. I initially wanted to flip NFTs but found I started with too small of a budget, ended up holding certain NFTs for too long because I either fell in love with them or was afraid I would sell and they would moon. Here is my advice for each group when setting a budget:

For the collector

- Only play with money you can afford to lose

- Consider setting aside a portion of your income so that you can buy NFTs for your collection at regular intervals. You can use the time between paychecks to research and make an informed purchase.

- Budget for gas fees. Gas fees are a reality and can wreck any strategy. Be sure to account for these fees when setting your budget.

For the Flipper

- Only play with money you can afford to lose

- If you are flipping, your risk of loss is much higher. Please do not play this game with an amount of money you are uncomfortable losing.

- Account for gas fees. Even more so than the collector or long term investor, gas fees can wreck an NFT flipper.

- Take extra time to save up a few extra bucks and do research in the meantime.

2. Look For Art You Like & Understand

Especially important for the collector, be sure to buy NFT art you both appreciate and understand. With so many projects popping up, it is easy to get distracted and jump at something you may not love in a year or even a couple months. Also for the flipper/investor, there are so many NFTs out there, it does not make sense to buy something you don’t appreciate or understand.

Sometimes I see an NFT drop and just think “I don’t get it”. If that’s the case, probably a good idea to move on and find something you do appreciate. For me, anything zombie related falls into that category. I think the artwork on some of these projects are great but I don’t get the zombie thing, never watched Walking Dead, just don’t get it. So I look elsewhere.

This Kobe Bryant piece by Boss Logic on the other hand, right up my alley. I understand this and would be proud to display it in my wallet or on my TV. Someone else on the other hand may much prefer a zombie of some sort. Beauty is in the eye of the beholder and you should not try to be someone you are.

You can click on the photo of Forever Mamba to view the animated version on Open Sea.

3. Who Is Behind The Project?

So many of these projects are offering future utility. So many of the people behind these projects are operating in anonymity. What is to stop them from pulling the rug and failing to deliver on the promised utility? Hopefully human decency but that is no guarantee.

I think buying a project from someone who 1) you know who they actually are 2) has some credentials that qualify them to launch a successful project and 3) has a track record of delivering to their fans and followers. Gary Vaynerchuk with VeeFriends is a prime example. Gary Vee has put a lot of pressure on himself to deliver utility to VeeFriends owners and I believe he will. If he promises VeeFriends holders a token to VeeCon in 2022 and fails to deliver on that, his reputation and entire business take a hit.

I feel very good about the long term viability of projects like VeeFriends, Tom Sachs Rocket Factory, and World of Women are all projects whose creators are known and recognized. One upcoming project I like where the creator is a known, established artist (and has a more reasonable entry point than the 3 previously mentioned projects) is Crypto-Pills by Micha Klein. He has his name attached to the project and is intrinsically motivated to deliver promised utility and make the project a success.

4. Projects That Have “Juice”

Marketing plays a big part in the success of an NFT project. It’s just the way it is. Does the team have the ability and the following to market the project well. Are there celebrities or influencers joining the community who will give the project “Juice”? I’ve watch several projects have their floor price increase 300%-500% in less than 24 hours after Gary Vee tweeted about them. If Gary Vee tweets about it (2.4 Million followers on Twitter) you better get in fast though.

Doing some research on who is involved in a project is worth the time. Rumble Kong League is a great example of this. Ja Rule and NBA player Tyrese Halliburton were early adopters of RKL. This intrigued me and I bought a Kong for 0.29 ETH. I was trying to flip so I sold the Kong around .45 ETH. Since then, two-time NBA MVP Steph Curry has purchased a Rumble Kong. The floor now sits at 1.2 ETH just a couple weeks later. Celebrity/Influencer involvement can be an important factor and give a project the “juice” it needs to move up in price.

5. Supply

First lets talk about supply. Most of these projects have a limited supply and NFT creators seem to grasp the idea that supply must be limited and rare items are likely to hold value. I believe the fundamentals of supply and scarcity are one of the things that have made the NFT culture so successful.

Before making a purchase, you need to do your research and understand a couple things.

- Know the overall supply of the project

- Look into whether the overall supply might be increased at some point

- Understand rarity

You can find the overall supply by going to the website and/or OpenSea. You will need to do some deeper research to know what the future plans of the project are and whether the dev team plans to introduce more supply. Lastly, you should get to know rarity.tools. It is a great free resource where you can find the rarity of an individual NFT within a project. When you search a project, it can be sorted by the most rare item to the least.

6. Demand

The other fundamental to understand is how much demand there is for any given project. Demand can be roughly measured by searching Twitter and see who is talking about the project. Is is trending? Are they adding new followers on Twitter? Is the Discord community growing? Unfortunately these metrics are only a small part of the picture and doesn’t necessarily mean the project is going up in value.

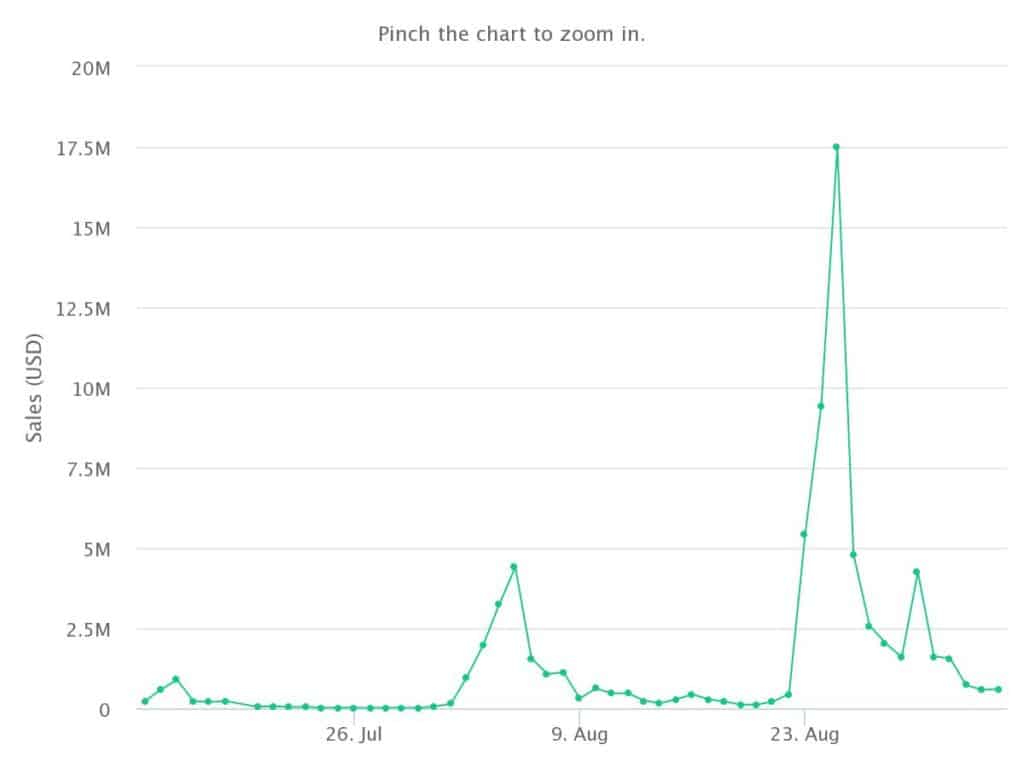

The best way to measure demand is to look at a daily or hourly chart of sales volume. If sales volume is increasing and price is increasing with it, that is a good indication that demand is picking up. When buyers stop showing up (a.k.a. demand is decreasing), that is when we see the floor start dropping. You notice people trying to off-load their NFTs and listing them lower and lower to try to be the one that actually sells. This can happen in a hurry.

This chart of Curio Cards sales volume shows how sales volume was starting to increase along with price right before sales volume and price both exploded. You want to be buying in when the sales volume and price are just starting to trend up.

7. Utility

We are in the wild west of the NFT market. Projects are launching every day. Almost every one of them is promising some form of utility. Whether it be in the form of physical prizes, future NFT drops, experiences, or the potential to earn income in a future game, just about everyone is promising something. Ability to deliver on these promises will make or break these projects in the future. Ask yourself:

- Is the utility the NFT is offering something I’m REALLY excited about?

- Does the dev team seem like they are ready to deliver and have an actual plan or are they just buying time?

- Will this NFT continue to deliver utility well into the future?

The way Bored Ape Yacht Club recently delivered utility to their members is a great example. Owners of BAYC were already doing just fine. Members of the Bored Ape Yacht Club were given the opportunity to give their Bored Ape a “serum” that would mint an additional “Mutant Ape”. Holders still retain their original asset while getting airdropped an additional NFT. Mutant Apes quickly reached a floor of 5 ETH (approx $17,500 at the time) and a handful of Mutant Ape Yacht Club NFTs have already sold for high 6 figures. This is just insane. So many of these Bored Ape holders were already holding assets worth 6-7 figures, then they get air dropped…I said AIR DROPPED another asset worth 5-6 figures. What is happening?

The utility offered by holding an NFT should be seriously considered.